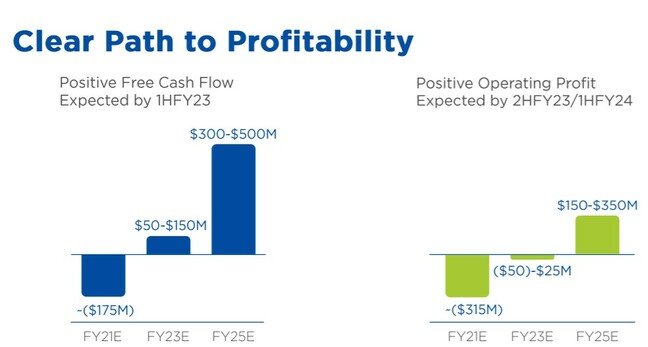

Nutanix told investors it had a “clear path to profitability” and predicted it could publish black ink in just two years.

The hyperconvergent shot made that prediction on Investor’s Day on Tuesday, in which CEO Rajiv Ramaswami offered investors the slide below.

Nutanix reported its results for the third quarter of 2021 at the end of May 2021. That is why Ramaswami said The register that cash flow positivity is achievable by the end of the 2022 calendar year and actual black ink may expire in 2023. The company was founded in 2009 and sails in 2016.

The CEO said the company’s move to subscription plans is the main reason for the solar forecast, as it allows Nutanix to forecast revenue while requiring less effort to renew subscriptions than for new sales. Ramaswami said Nutanix can’t help but engage with customers more often when they’re subscribers to ensure they get value for money from their monthly fees. This increased contact creates opportunities – both for customer satisfaction and for selling more – and also reduces sales and marketing costs.

Ramaswami also told investors that Nutanix has moved from growth investments to a more prudent use of its resources. The result of this approach is that the company will put more effort into markets that it considers natural additions to its portfolio and will probably appeal to current customers. He therefore emphasized Nutanix’s belief in the potential of managed databases and the hybrid cloud business, but said efforts such as providing the latest Arm processors, increasingly preferred by large clouds, could wait until a proven market is formed.

The CEO was also optimistic because he saw that industries that depended on discretionary spending and tourism were starting to spend again.

“Over the last quarter, we have begun to see orders from casinos, as well as from the transport and hospitality sectors,” he said, suggesting that their need for more technology signals widespread relief that the global economy is recovering from the COVID recession.

Nutanix also announced that Virginia Gambale will become the new chairman of the board. Gambale is a managing partner of the strategic consulting firm Azimuth Partners LLC and is already chairman of the Nomination and Corporate Governance Committee of the company and is a member of its audit committee. She succeeds the company’s founder Dheeraj Pandey.

Ramaswami said her appointment expresses another of Nutanix’s priorities – namely, the use of diversity as a differentiator, unlike its previous position of opportunistic diversity. ®