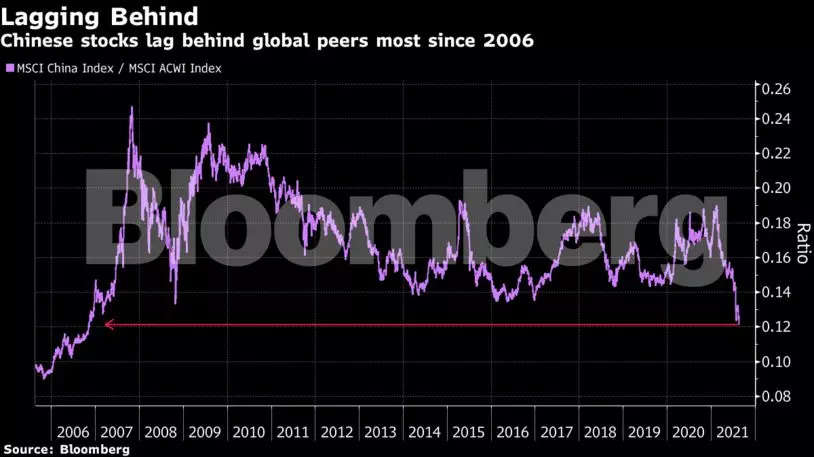

Even a $ 1.5 trillion sale may not provide an attractive starting point for equity investors as they struggle with cascading risks in China’s technology sector.

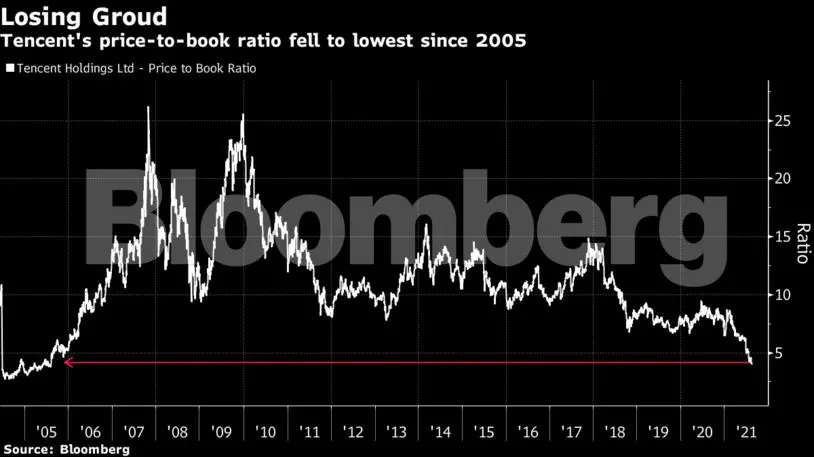

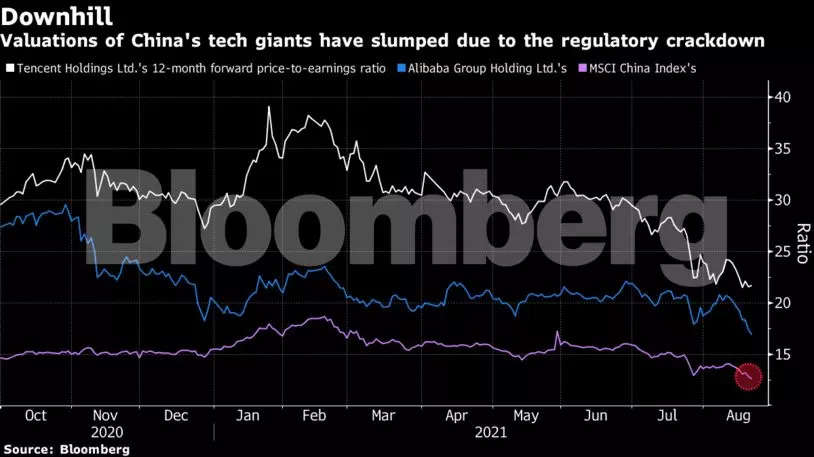

Leaving shares, caused by Beijing’s expanding restrictions, he left Tencent Holdings Ltd. trade at a lower price / balance ratio than during the financial crisis in 2008 Alibaba Group Holding Ltd. fell to a record low in Hong Kong, where the main stock index fell on a bear market this week. Despite declining estimates so rapidly, the rate of outflows indicates that few buy signals are flashing.

“I don’t think this will end very soon,” said Alex Au, managing director of Alphalex Capital Management HK Ltd. positions in stocks he once favored. “Investors need to reassess the rationale and risk of invests in China. ”

Tencent warned investors this week to prepare for more regulatory restrictions on China’s technology sector. Those like Au believe that the technology sector is the most vulnerable amid widespread repression that has turned industries from education and online commerce to car sharing.

Since the peak of February, the four companies that have lost the largest market value worldwide are all Chinese technology companies: Tencent, Alibaba, Kuaishou Technology and Meituan have seen more than $ 1 trillion destroyed together. The Hang Seng Tech Index, which tracks China’s largest technology companies, lost more than 40 percent during that time. Its members saw the value of about $ 1.5 trillion evaporate.

How far President Xi Jinping’s crackdown on the transformation of some of the country’s largest companies will go and where opportunities can be found are key questions for investors who are learning to shift to the new normal.

Pricing in the dark

Given the current state of regulatory uncertainty, it’s hard to say that technology stocks are cheap at the moment, said Sean Taylor, APAC’s chief investment officer and DWS’s emerging market equity manager.

“If profits continue to fall, it’s still expensive,” he told Bloomberg TV at current levels. “We don’t know where the bottom is.”

Next trigger

Investors from the continent, who were big buyers of technology stocks when foreign traders sold in February and March, have become net sellers of Tencent since June, according to data collected by Bloomberg.

Purchase signals will only appear when there is clarity in government policy, said Li Weizing, a Shenzhen-based fund manager at JH Investment Management Co. He said he sold his shares in Internet companies in the fourth quarter of last year and “plans to monitor things from a distance” for now.

Squeeze profit

A tighter political environment has forced companies to slow down expansion plans, while antitrust enforcement puts them at greater competition. Alibaba’s revenue missed forecasts for the first time in two years as growth slowed everywhere from the cloud to e-commerce divisions.

Tencent reported its slowest pace of quarterly revenue growth since early 2019 and warned of impending new regulatory restrictions. It also doubles the amount it spends on social responsibility programs to $ 15 billion, marking one of the biggest philanthropic efforts of China’s Internet giants as regulatory scrutiny tightens.

Investors need clarity both on how much regulators will prosecute companies and on how companies will respond, said Tai Hui, Asia’s chief market strategist. JPMorgan asset management. “Current assessments may not fully reflect what lies ahead,” he said.

Opportunities

Some see a tipping point on the horizon because the recent sale of technology has been so drastic.

“When you disassemble the sum of the parts and find that some of these companies trade significantly below the core business and many ancillary parts of the business, whether you receive payments or cloud businesses for free, the estimates are very convincing,” said Louis Lau, director of investment. at Brandes Investment Partners. “In five years, I think this will be one of the best opportunities to buy.”