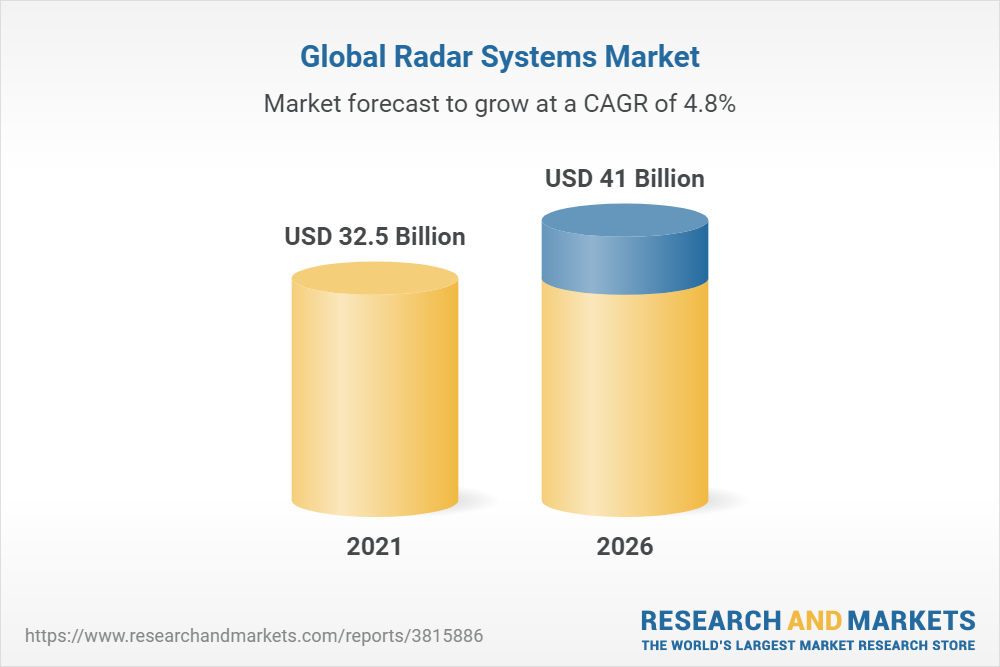

Global Radar Systems Market

Dublin, March 15, 2022 (GLOBE NEWSWIRE) – The “Radar Systems Market by Application, Platform (Air, Marine, Unmanned, Land, Space), Frequency Band, Type, Component, Range, Dimension, Technology, & Region, (North America, Europe, Asia Pacific, Middle East & Africa and Latin America) – Forecast to 2026 “ report has been added to ResearchAndMarkets.com’s offering.

The radar systems market is estimated to be USD 32.5 billion in 2021 and is projected to reach USD 41.0 billion by 2026, at a CAGR of 4.8% from 2021 to 2026.

Growth of this market can be attributed to the rise in trade of radar systems, developments in the defense sector, and national security sector.

Increasing demand for advanced weather monitoring radar to drive the market for radar systems during the forecast period

Weather monitoring radar, also known as weather surveillance radar (WSR) and Doppler weather radar, are developed to detect precipitation (rain, snow, and hail, among others) and calculate its direction of motion in order to estimate weather conditions in a particular region at a given time. These radar are used across commercial, scientific, and military applications, with many companies actively developing new technologies for use in weather monitoring. For instance, In June 2020, Honeywell (US) developed the IntuVue RDR-7000 Weather Radar System, which can be used in military and defense applications. The IntuVue RDR-7000 can also be used on urban mobility platforms such as air taxis and airborne emergency vehicles.

Development of Active Electronically Scanned Array Radar

Active electronically scanned array (AESA) radar technology is a module containing a new generation of transceiver modules. Software-defined radio (SDR) is used for radio communication because of its high data rates. The use of AESA technology is growing rapidly because of its enhanced reliability and affordability and is expected to replace conventional radar systems in the near future. This has allowed countries such as the US, Norway, the Netherlands, India, and Israel, among others, to incorporate AESA into legacy / old systems on land, sea, and airborne platforms.

Due to its resistance to electronic jamming, low interception, high reliability, and multi-mode capability, countries around the world are adding AESA radar into their military aircraft and vessels and manufacturers around the world are working to meet demand. Incorporating AESA radar into aircraft / sea / or ground platforms will remain relevant as electronic warfare becomes more important and without AESA, modern conventional militaries are obsolete.

Europe: The largest contributing region in the radar systems market.

Europe is the largest market for radar systems in terms of demand as well as the presence of key radar systems manufacturers. The region accounted for a total share of 33.8% of the global Radar systems market in 2020. Europe has many countries that invest a good amount of money in defense infrastructure. This results in a high requirement of radar systems in Europe.

Key Topics Covered:

1 Introduction

2 Research Methodology

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Emergence of Modern Electronic Warfare and Network-Centric Warfare

5.2.1.2 Development of Phased Array Solid-State Radar

5.2.1.3 Significant Investments by Governments to Upgrade Existing Fighter Aircraft Radar

5.2.1.4 Increasing Defense Expenditure of Emerging Economies

5.2.1.5 Increased Demand for Advanced Weather Monitoring Radar

5.2.2 Restraints

5.2.2.1 Limited Bandwidth for Commercial Applications due to Preference for Military Use

5.2.3 Opportunities

5.2.3.1 Rise in Adoption of Unmanned Aerial Vehicles and Lightweight Radar

5.2.3.2 Development of Low-Cost and Miniaturized Radar

5.2.4 Challenges

5.2.4.1 Stringent Cross-Border Trading Policies

5.2.4.2 Susceptibility to New Jamming Techniques

5.3 COVID-19 Impact Scenarios

5.4 Impact of COVID-19 on Radar Systems Market

5.4.1 Demand-Side Impact

5.4.1.1 Key Developments from January 2020 to August 2021

5.4.2 Supply-Side Impact

5.5 Trends / Disruptions Impacting Customers’ Business

5.5.1 Radar Systems in Unmanned Surface Vessels (Usv)

5.6 Market Ecosystem

5.6.1 Prominent Companies

5.6.2 Private and Small Enterprises

5.6.3 End-users

5.7 Pricing Analysis

5.7.1 Average Selling Price Analysis of Radar Systems in 2020 (USD Million)

5.8 Tariff Regulatory Landscape of Maritime Industry

5.9 Trade Data

5.10 Value Chain Analysis of Radar Systems Market

5.10.1 Research & Development

5.10.2 Raw Material

5.10.3 Component / Product Manufacturers (Oems)

5.10.4 Assemblers & Integrators

5.10.5 End-users

5.11 Porter’s Five Forces Model

5.12 Technology Analysis

5.13 Use Cases

5.14 Operational Data

6 Industry Trends

6.1 Introduction

6.2 Supply Chain Analysis

6.2.1 Major Companies

6.2.2 Small and Medium Enterprises

6.2.3 End-users / Customers

6.3 Emerging Industry Trends

6.3.1 Software-Defined Radar

6.3.2 By (Multiple Inputs / Multiple Outputs)

6.3.3 Active Electronically Steered Array (Aesa)

6.3.4 Inverse Synthetic Aperture Radar (Isar)

6.3.5 Quantum Radar

6.3.6 Digital Beam Forming Technique in Radar

6.3.7 4D Electronically Scanned Array Radar Systems

6.4 Impact of Megatrends

6.4.1 Digitalization and Introduction of Internet of Things (Iot) Systems in Airborne Radar

6.4.2 Shift in Global Economic Power

6.5 Innovations and Patent Registrations

7 Radar Systems Market, by Platform

7.1 Introduction

7.2 Air

7.2.1 Aew & C Systems Use Radar for Command & Coordination

7.2.2 Commercial Aircraft

7.2.2.1 Fixed-Wing Aircraft

7.2.2.1.1 High Demand for Radar for Navigation Purposes

7.2.2.2 Rotary-Wing Aircraft

7.2.2.2.1 Increased Demand for Rescue Missions and Recreational Use

7.2.3 Military Aircraft

7.2.3.1 Fixed-Wing Aircraft

7.2.3.1.1 Security and Air Dominance – Key Operations Performed by Radar Systems in Fixed-Wing Aircraft

7.2.3.2 Rotary-Wing Aircraft

7.2.3.2.1 Development of Large-Capacity Military Rotary-Wing Aircraft Boosts Segment

7.3 Marine

7.3.1 Marine Radar Systems Widely Used for Navigation and Collision Avoidance

7.3.2 Commercial Vessels

7.3.2.1 Demand Driven by Tourism and Freight Services

7.3.3 Military Vessels

7.3.3.1 Technological Advancements Underway in Stealth Ships Equipped with Modern Isr and Radar Systems

7.4 Unmanned

7.4.1 Unmanned Systems Typically Equipped with Navigation Radar Systems

7.4.2 Uav

7.4.2.1 Demand for Scientific Research Boosts Segment

7.4.3 Ugv

7.4.3.1 Help Gather Information from Inaccessible Areas

7.4.4 Adoption

7.4.4.1 Increasing Use in Militaries to Boost Segment

7.5 Land

7.5.1 Increased Need for Border Surveillance Drives Land Segment

7.5.2 Fixed Radar Systems

7.5.2.1 Demand to Monitor Strategic Locations Drives Segment

7.5.2.2 Air Defense Systems

7.5.2.3 Weather Stations

7.5.2.4 Border Surveillance Systems

7.5.2.5 Air Traffic Monitoring Stations

7.5.3 Portable Radar Systems

7.5.3.1 Need to Detect Smuggling Activities at Borders – Key Segment Driver

7.5.4 Mobile Radar Systems

7.5.4.1 Used Widely in Military and Commercial Applications

7.6 Space

7.6.1 Moving Target Identification and High-Resolution Digital Mapping – Possible with Space Radar

7.6.2 Satellites

7.6.3 Spacecraft

8 Radar System Market, by Frequency Band

8.1 Introduction

8.2 Single Band

8.2.1 Microwave Radar Dominates Single Band Radar Market

8.2.2 Radio Waves

8.2.2.1 U / V Hf Band

8.2.3 Microwave

8.2.3.1 L-Band

8.2.3.2 S-Band

8.2.3.3 C-Band

8.2.3.4 X-Band

8.2.3.5 K- / Ku- / Ka-Band

8.2.3.6 Others

8.2.4 Millimeter Wave

8.3 Multiband

8.3.1 Used for Coherent Detection and Tracking of Moving Target Objects

9 Radar Systems Market, by Component

9.1 Introduction

9.2 Antenna

9.2.1 Electronically Steered Arrays to Dominate Antenna Segment

9.2.2 Rotating Antennas

9.2.3 Electronically Steered Array

9.2.3.1 Active Arrays

9.2.3.2 Passive Arrays

9.2.4 Microstrip Antennas

9.3 Transmitters

9.3.1 Solid-State Radar Transmitter Segment to Lead Transmitter Segment

9.3.2 Magnetron

9.3.3 Solid-State Radar Transmitter

9.4 Receiver

9.4.1 Radar Receivers Optimize Detection Capacity with Bandwidth Characteristics

9.4.2 Amplifier

9.4.3 Mixer

9.4.4 Signal Processor

9.4.5 Display

9.5 Duplexer

9.5.1 Duplexer – Switch That Simultaneously Connects Antenna to Transmitter and Receiver

9.6 Waveguide

9.6.1 Used in Radar Systems to Carry Microwave & Millimeter Wave Signals

10 Radar Systems Market, by Type

10.1 Introduction.

10.2 Active Radar

10.2.1 Development of Electrically Scanned Array Radar to Boost Market for Active Radar Systems

10.2.2 Doppler Radar

10.2.2.1 Single Wave Doppler Radar

10.2.2.2 Pulse-Doppler Radar

10.2.3 Continuous Wave Radar

10.2.3.1 Frequency Modulated Continuous Wave Radar (Fmcw Radar)

10.2.3.2 Moving Target Indicator Radar (Mti Radar)

10.2.3.3 Synthetic Aperture Radar (Sar)

10.3 Passive Radar

10.3.1 Widely Used in Stealth and Covert Operations

11 Radar Systems Market, by Application

11.1 Introduction

11.2 Commercial

11.2.1 Increasing Use in Weather Monitoring Application to Fuel Growth

11.2.2 Aircraft Monitoring & Surveillance

11.2.3 Weather Monitoring

11.2.4 Airport Perimeter Security

11.2.5 Critical Infrastructure

11.3 National Security

11.3.1 Increasing Use in Search & Rescue Operations Fuels Segment

11.3.2 Search & Rescue

11.3.3 Border Surveillance

11.3.4 Isr

11.4 Defense

11.4.1 Rising Demand for Radar-Based Security & Surveillance Applications Drives Segment

11.4.2 Perimeter Security

11.4.3 Battlefield Surveillance

11.4.4 Military Space Assets

11.4.5 Air Defense

12 Radar System Market, by Range

12.1 Introduction

12.2 Short-Range Radar

12.2.1 Used Primarily in Commercial Applications or Man-Portable Reconnaissance Missions

12.3 Medium-Range Radar

12.3.1 Widely Used Across Military Applications

12.4 Long-Range Radar

12.4.1 Used for Long-Distance and Accurate Location Tracking

13 Radar Systems Market, by Technology

13.1 Introduction

13.2 Software-Defined Radar (Sdr)

13.2.1 Segment Driven by Lightweight and Easily Customizable Features

13.3 Conventional Radar

13.3.1 Majorly Used in Detection and Imaging Applications

14 Radar Systems Market, by Dimension

14.1 Introduction

14.2 2D

14.2.1 2D Radar Used Mainly for Air Traffic Management

14.3 3D

14.3.1 High Target Location Accuracy and Automatic Operation Modes Drive 3D Radar Segment

14.4 4D

14.4.1 4D Radar Used in Autonomous Tactical Surveillance Vehicles for Accurate Target Mapping

15 Regional Analysis

16 Competitive Landscape

17 Company Profiles

17.1 Key Players

17.1.1 Northrop Grumman Corporation

17.1.3 Lockheed Martin Corporation

17.1.4 Raytheon Technologies Company

17.1.6 The Boeing Company

17.1.7 General Dynamics Corporation

17.1.8 Thales

17.1.9 Kongsberg

17.1.10 Saab Ab

1/17/11 Honeywell International Inc.

17.1.12 Bae Systems

17.1.13 Leonardo SPA

1/17/14 Israel Aerospace Industries

17.1.15 Aselsan AS

1/17/16 Elbit Systems

1/17/17 Indra Company

1/17/18 Garmin Limited

1/17/19 Bharat Electronics Ltd.

17.1.20 Airbus Group

17.1.21 Mitsubishi Electric

17.1.22 L3Harris Technologies

17.1.23 Src, Inc.

17.1.24 Hensoldt Ag

17.1.25 Telephonics Corporation

17.1.26 Ainstein Radar Systems

17.1.27 Optimare Systems GmbH

18 Appendix

For more information about this report visit https://www.researchandmarkets.com/r/km5jtb

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900