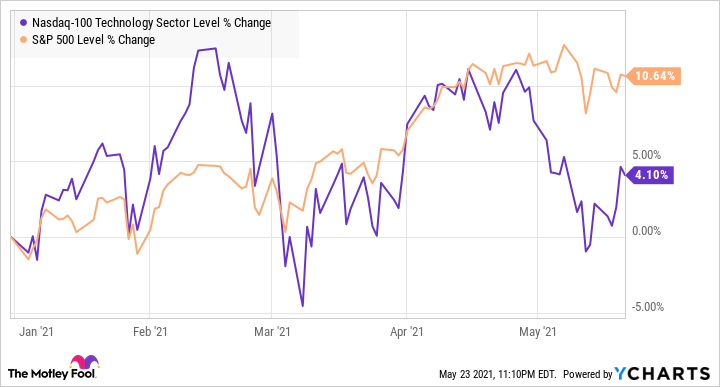

The S&P 500 has so far achieved double-digit percentage gains so far in 2021, but several technology stocks have been hit by volatility as investors have panicked at the sight of rising inflation and rich valuations and are now trading at adjustment levels. Technologically heavy Technology sector NASDAQ-100 performed worse than the S&P 500, as some investors won a great profit scored last year.

But the technology sell-off has also created a great opportunity for investors to take down shares in some fast-growing companies that are taking advantage of hot technology trends. Palo Alto Networks (NYSE: PANW) and Skyworks Solutions (NASDAQ: SWKS) are two stocks that investors should look at.

These two stocks are not only cheap at the moment, but will also gain big on arrival 5G (fifth generation) wireless networks – a market that is still in the early stages of growth. Let’s see how.

^ NDXT data from YCharts

1. Palo Alto Networks

The growing deployment of 5G networks around the world poses new challenges to cybersecurity. This is because 5G stimulates a huge increase in the number of connected devices in several verticals, inclusive Internet of Things (IoT), related cars, factory automation and smartphones, among others.

Telecommunications operators will need to provide local small cellular sites that are key to 5G deployment, while tackling the challenge of software-defined networks that decentralize data from one place to many. In simpler terms, the introduction of 5G is expected to create more room for attack by bad actors. As a result, organizations and governments will need to strengthen their cybersecurity capacity to keep their systems running safely in this new era of high-speed network technology.

Image source: Getty Images.

Not surprisingly, the cost of 5G security is expected to grow by a solid 44% per year in 2026 to $ 5.2 billion, according to a third country. That would be a huge step up from the $ 580 million spent last year.

Palo Alto Networks is a great way to take advantage of this leap in 5G cybersecurity costs. The cybersecurity specialist launched what he called “the first security proposal in the 5G home industry” in November last year. This solution allows businesses and service providers to protect the core of their 5G networks and to protect end networks and applications that are closer to the input source rather than the centralized center. The autonomous car is an example of final calculations, as the data generated by the vehicle must be processed quickly to help it make quick decisions on the road.

In addition, Palo Alto’s solution allows real-time monitoring of threats to prevent 5G devices and subscribers from being attacked. And Palo Alto’s 5G cybersecurity solution is already gaining momentum: Singapore-based telecommunications company StarHub chose Palo Alto’s native 5G security platform by the end of 2020. This was a good endorsement for Palo Alto’s product, as StarHub controls 27% of the telecommunications market in Singapore.

Palo Alto Networks is already growing in impressive pace thanks to the cloud security market and the addition of 5G to the mix can give it a nice shot in the hand. Analysts expect Palo Alto to achieve strong double-digit revenue growth over the next two fiscal years, while the long-term bottom line growth forecast of over 60% is also exceptional.

Throw in the fact that Palo Alto is trading at 8.7 times sales and 52 times forward profits compared to the average multiples for 2020 of 9.6 and 65, respectively, and the shares look tempting at the moment. The stock market crash could make it even more attractive, which is why investors want to add 5G stock to their portfolio must keep Palo Alto within their sights.

2. Skyworks Solutions

Skyworks Solutions is in excellent shape financially, however Apple (NASDAQ: AAPL) supplier has fallen out of favor in the stock market. Investors quickly pressed the sell button, though Skyworks deliver exclusive Q2 report and guidelines at the end of April and the mood has not changed since then.

But there are a few simple reasons why investors looking to take advantage of the 5G market should buy the Skyworks crash – the company’s great growth is one.

Apple’s vendor revenue grew 53 percent year-over-year in the second quarter to a record $ 1.17 billion, and non-GAAP earnings rose 72 percent year-over-year to $ 2.37 a share in the quarter. Rising sales of 5G smartphones have played a key role in this great growth, as Skyworks receives 67% of its revenue from the sale of chips to smartphone makers (OEMs).

Apple is doing most of the hard work for Skyworks’ huge growth. The manufacturer of the iPhone represents 56% from the chipmaker’s revenue, thanks to the use of multiple RF chips in the latest iPhone 12 range, the success of which has had a positive impact on Skyworks. The The iPhone 12 dominates 5G smartphone sales charts and Apple is on track to break its existing annual sales record by delivering about 240 million more iPhones this year. It can build on that success next year, as does the production of this year’s iPhone models is expected to be higher from the iPhone 12.

In addition, notes Apple analyst Ming-Chi Kuo, predicts that Apple may release a 5G version of the iPhone SE with an entry level in early 2022. Such a move could give Apple access to a wider audience than 5G smartphones and to give the prospects of Skyworks a nice shot in the hand. In addition, investors must not forget that the 5G smartphone market will explode in the coming years. Skyworks is delivering your chips to the best companies in the space, while finding great grip in the Internet of Things markets.

These side winds show why analysts expect Skyworks’ profits to maintain an annual growth rate for tall teenagers in the long run. The company is earning more than 5G smartphones and has other catalysts that can help it exceed expectations in the future. All this makes Skyworks one of shares with the highest growth investors have to buy right now – or in a market crash – as they are trading only 15 times forward.

This article presents the opinion of the writer, who may disagree with the “official” position of the recommendation of Motley Fool’s first-class consulting service. We are colorful! Challenging an investment thesis – even one of our own – helps us think critically about investing and make decisions that help us become smarter, happier and richer.