The possibility of SDR is also significant, as BEL already offers a version of SDR (naval combat) and SDR-Air is under evaluation.

The possibility of SDR is also significant, as BEL already offers a version of SDR (naval combat) and SDR-Air is under evaluation.

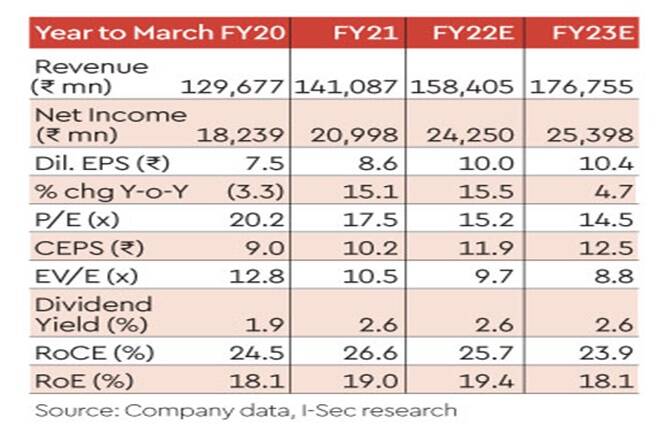

Bharat Electronics (BEL) continues to impress with 9% annual growth on the top line and 150bps on an annual basis self-expanding Ebitda’s margin for FY21 – a year with almost lost Q1FY21 (revenue fell 20% year on year in Q1FY21) due to the pandemic. There is a working capital release of Rs 23 billion for FY21, driven by Rs 28 billion in working capital release H2FY21 – another remarkable statistic. In addition to the achievements, the order is 152 billion rupees (~ 54 billion rupees for Q4FY21), thus maintaining a healthy book up to an invoice of 3.9 times the FY21e (standalone) top line of ~ 140 billion. The presentation of BEL continues to stand out (performance + margin + visibility of the order book) in the listed DPSU space. We continue to maintain a purchase with a revised target price of Rs 177 (Rs 153 earlier)

FY21 order inflow at Rs 152 billion: The FY22 order pipeline is also quite visible with ~ Rs 125 billion. Missile orders to BDL and Rs 380 billion. From LCA Mk1A orders to HAL. Q4FY21 witnessed an RUR 10 billion inflow of software-defined radio (tactical) orders for the Indian Navy. The possibility of SDR is also significant, as BEL is already supplying an SDR (Naval combat) version and SDR-Air is under evaluation.

Short-term order options: BEL has already accounted for the avionics performance associated with LCA Mk 2, as HAL has received an LoI for the same. Future options include Jammer for LCA. LUH and LCH (helicopters) can also allow sensors and weapons to significantly increase BEL avionics revenue.

The focus will be on diversification and implementation: BEL’s objectives: (i) to increase the civic segment from 7% of the upper line to 15% over the next 2-3 years; (ii) increase the current contribution by 10% of revenues from the services sector; (iii) capture a share of the armed forces’ revenue budget by entering electronic fuses and radio frequency finders (a new complex in Machilipatnam will be introduced soon); and (iv) to gain a stake in the core business, i.e. integration of a missile complex (Palasamudram; another separate SBU for QRSAM in Bengaluru), entry into ammunition, etc. digital revenue growth.

Maintain BUY: We estimate BEL at 17x gains for FY23e (against 15x FY22e earlier). We support a purchase with a revised TP of Rs 177 / share. BEL continues to surprise in terms of performance, margins, order inflows, growth, although it has reached a commendable scale (compared to India’s defense budget) – FY21’s performance underscores the strength of the core business model.

Take live Stock prices from NOW,, If,, American market and the latest NAV, a portfolio from Mutual funds, See the latest IPO News,, Best performing initial public offerings, calculate your tax on Income tax calculator, I know the market Top winners,, Top losers & Best mutual funds. Like us on Facebook and follow us Twitter.

![]() Financial Express is already on Telegram. Click here to join our channel and stay up to date with the latest Biz news and updates.

Financial Express is already on Telegram. Click here to join our channel and stay up to date with the latest Biz news and updates.